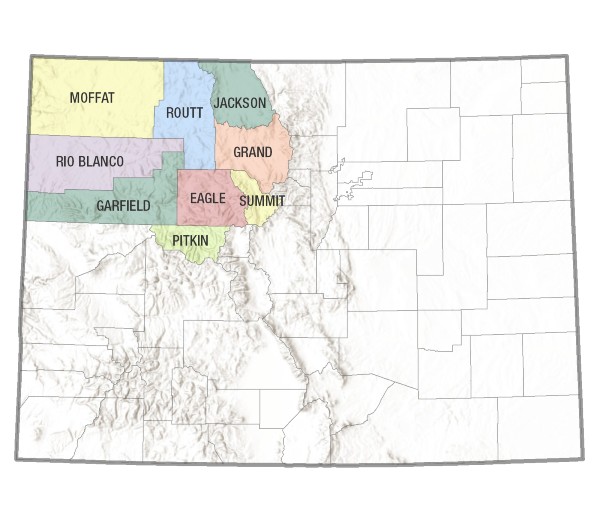

Who We Are

The ideal Northwest Loan Fund (NLF) client is a new or growing business within our service area that is creating jobs or providing positive economic impact for the local economy. The categories for which the NLF makes loans include:

- Acquisition of an existing business

- Business expansion

- Start-up costs for a new or expanding business

- Purchase of business-occupied real estate

- Purchase of equipment, furniture and fixtures

- Inventory and working capital

The program does require collateral, though it can often participate with other lenders to take a collateral position behind those lenders. Size and term will vary. Most loans have ranged from $10,000 to $500,000. With fees at 2-3% and favorable interest rates, NLF loans are very competitive. The NLF is often able to take greater risks than conventional banks because the program exists to help with local economic development, so it is able to welcome new and expanding businesses that may not yet qualify for traditional bank financing for various reasons. The NLF often partners with banks or private lenders to fill a gap that may exist between a the needs of a business and the traditional financing for which they currently qualify.